As Abraham Lincoln once said, “Give me six hours to chop down a tree and I will spend the first four sharpening the axe.” Planning and preparation are two of the most important things you can do when getting ready for a natural disaster such as a tornado.

According to the National Severe Storms Laboratory (NSSL) of the National Oceanic & Atmospheric Administration (NOAA), Americans experience an average of 1,253 tornadoes every year, more than any other country. Climate change is said to be the general cause of the ever-increasing severe weather conditions across the US.

Recent AccuWeather.com Tornado Forecasts have included annual predictions for:

>1,350 tornadoes

Not long ago, tornadoes were responsible for more than $105 billion in total damages across the US, which included the highest number of tornado fatalities in recent years. It’s important to note that thunderstorms accompanying a tornado can produce damaging winds and floods, resulting in an additional $2 billion in damage annually. Texas, Kansas, Florida, Oklahoma, and Nebraska consistently experience the highest numbers of tornadoes annually. Add in states like Louisiana, Iowa, and South Dakota, and you’ve got the loosely defined area known as Tornado Alley. NOAA states that a typical tornado travels approximately 10-20 mph and is on the ground for an average of only five minutes.

How long is the tornado season in America?

While NOAA notes that tornadoes can occur at any time of the year if conditions permit, there are peak months when certain states receive the most tornado activity:

- Gulf Coast – early spring

- Midwest – June to July

- Central Plains – May to June

How DomiDocs can help you navigate through a storm.

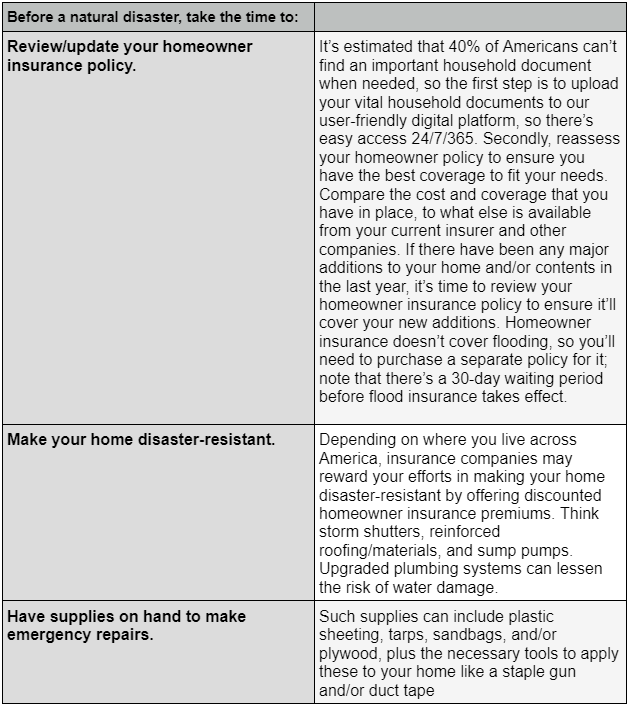

The keys to helping you weather any natural disaster are always going to be the same: knowledge and organization. It basically comes down to homeowner responsibility and doing your due diligence to protect both your family and your home before a disaster strikes. Use the secure, award-winning DomiDocs homeowner platform to:

- upload a detailed home inventory list itemizing your home’s contents including receipts, photos, and videos of your home’s current condition

- store and catalog your proprietary household paperwork using the Insurance Document Bundle feature where your insurance policies are listed to show the company, coverage, cost, and start- and end-date of each, displayed with a calendar timeline for quick reference when needed. Besides for your own use, you can share with your insurance agent at the touch of a button if need to file an insurance claim

- work your way through our comprehensive DomiDocs New Homeowner Guide offering best use instructions to help prevent homeowner claims

The Problem with Insurance Companies

When you’re in the midst of a dealing with a natural disaster, there’s no doubt you’ll also be dealing with your insurance company. DomiDocs CEO and Founder, William McKenna, advises to never accept your insurance company’s first settlement offer as chances are it’ll be a low-ball offer they’re just hoping you’ll take without question. Many attorneys agree that the initial offer by an insurance company should immediately be rejected. What should you do? Access your personal profile on the DomiDocs home management platform, and submit your documented receipts, photos, and videos to your insurance adjuster with just one click. Take the time to factor in missed wages, medical bills (current and future), vehicle repairs, and any other losses that occurred before accepting any settlement offers.

Never accept an insurance company’s first settlement offer:

McKenna himself was initially offered a $13,500 settlement offer for damages sustained to his home’s roof by a sudden, unexpected microburst. By providing his documentation

already stored in the DomiDocs homeowner platform,

McKenna’s settlement was increased to $201,000,

proving the true unmeasurable value of DomiDocs.

DomiDocs has your back! Whether it’s tornado preparedness, How To File an Insurance Claim, or mental health tips in our accompanying article, The DomiDocs Guide: What to Do After a Hurricane Hits, we’re here for every step of your homeowner journey.

DomiDocs HomeLock™ can provide you with an extra layer of protection by digitally locking your home against virtually all homeowner fraud, including title & deed theft. Why? Because property fraud is the fastest growing crime in America! Visit HomeLock™ today to watch our introduction video, and when you sign up, you’ll receive your comprehensive 7-year home history report and scan free of charge.

Author – Connie Motz