Advanced Technology to STOP Fraud Before, During & After.

~ Proactive & Comprehensive Title and Property Fraud Protection ~

Please be advised that we do not sell, trade, or share your personal data

with third parties. All information provided is maintained in strict

confidence and handled with the highest standards of security and privacy.

Our website is secure, ensuring that your personal information is protected

at all times. www.domidocs.com/privacy

Scroll Down to Learn More

- $200 Billion in Protected Property

- 5-Stars on all Rating Systems

- Protecting HomeOwners since 2016

- Seniors & Responders Discounts

- Multi-Property Discounts

- Long-Term License Discounts

Free title scan via chat

- 100% Customer Satisfaction

- Covers All Types of Title Fraud

- Fraud Restoration Services

Property Fraud

News Ticker

AI-Powered Home Title Protection:

Smarter, Faster, Stronger

- AI Threat Analysis - Detects and interprets risk in real time.

- Threat Severity Index (1–4) - Understand urgency at a glance.

- Alerting Methodology - Bell, Email, Text, and Call notifications

- Homeowner Glossary - 900 key terms simplified and searchable.

No Comparison: The Industry’s Most Advanced Protection.

The ONLY company protecting against:

- Property Theft- Title, Deed Fraud & Forgeries

- Equity Theft- Fraudulent Loans & Lines of Credit

- Rental Theft- Unknown Rental & Revenue Theft

- Clouded Title- Fraudulent Claims & Encumbrances

- Lien Filings- 80+ Different Types of Property Liens

- Unknown Missed Payments - Mortgage, Taxes, Lease, POA/HOA

- Data Errors - County, State, Federal & Corporate Databases

Immediate detection and action is the best homeowner defense!

Here is EXACTLY Why You Want HomeLock™

- The only system that catches fraud before during and after it happens

- Single Most Proactive and Effective System Available

- Private Search Engine for Internet Address Monitoring

- Detailed 7-Year Home History Scans & Report Included

- Data Correction and Fraud Resolution Included

- Google 5-Star Rated Live U.S. Based Customer Service Team

- Powered by the DomiDocs Homeowner Enablement Platform®

Most vulnerable victims identified and ranked

- High equity, no mortgage homes

- Non-owner occupied homes

- Vacation homes

- Rental homes

- Investment properties

- Foreclosure properties

- Senior homeowners

- 1st-time homeowners

- Deployed military homeowners

- International homeowners

- Multiple homeowners

- ADA, Disabled homeowners

Register today to receive your Home History Scan!

What Happens when an Alert is Detected?

- 1. When alert is detected you'll receive an immediate notification.

- 2. Login & review the activity found for your property.

- 3. Snooze the alert if activity is known or expected.

- 4. If the alert is not expected, contact our property fraud protection team for next steps by using the chat feature right here on this page.

Has a Lien been placed on your property without your knowledge?

- Federal Liens

- HOA Liens

- Mechanics Liens

- Construction Liens

- Judicial Judgments

Don't be caught off guard. HomeLock continuously monitors these records, keeping you informed, 24/7/365.

200+ Data Points

Has someone listed your house for sale without your knowledge?

Has someone listed your house for sale without your knowledge?

- Multiple Listing Service (MLS)

- Realtor.com

- Zillow

- Trulia

- Redfin

- Craigslist

Sale Listings

Has your title been changed in public records and a new deed been issued?

Has your title been changed in public records and a new deed been issued?

- Government Databases

- State and County Recorders

- Official Records

- Third-Party Databases

- Judicial Judgments

Title Changes

Was your home, investment or vacation property listed for rent without your knowledge?

Was your home, investment or vacation property listed for rent without your knowledge?

- Craigslist

- Zillow

- Trulia

- Redfin

- Realtor.com

Rental Listings

Has your property been listed on major search engines

and the internet?

Has your property been listed on major search engines

and the internet?

- Bing

- Yahoo

- Duck Duck Go

- Popular Social Platforms

Property Address

Property Fraud is one of the Fastest Growing Crimes in America

$55 Trillion

283%

$36 Trillion

Property Fraud is one of the Fastest Growing Crimes in America.

$55 Trillion

283%

$36 Trillion

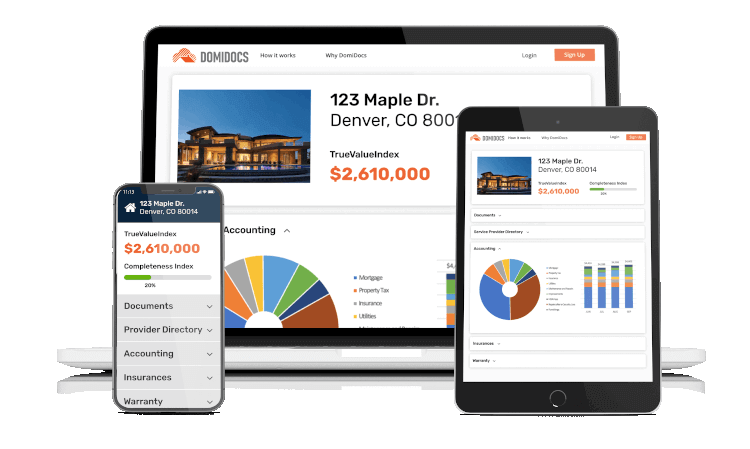

HomeLock™ includes our award winning

Homeowner Enablement Platform®

Value Tracking

Accounting

Calendar

Service Provider Management

Inventory Tracking

Education & Articles

Document Storage

Warranty Tracking

Partnered with Industry Leading Data & Security Companies

About Us: Advanced Property Fraud Protection

Property fraud is one of the fastest-growing financial crimes against homeowners. HomeLock® delivers proactive property fraud protection by monitoring your home for early warning signs of fraud, errors, and unauthorized activity. Using AI-driven, parcel-based monitoring, HomeLock scans over 200 data points daily, including title records, online marketplaces, rental platforms, lien filings, and public-record changes. If suspicious activity appears, HomeLock alerts you in real time so you can respond before damage escalates. HomeLock helps protect what matters most: your property, your ownership rights, and your equity.