What is a 4-Point Inspection?

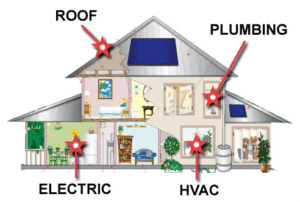

Insurance companies and underwriters use a 4-point inspection as a tool to determine risk within your home. This examination by a building contractor or licensed inspector will include 4 areas of your home to determine they’ve all been maintained and are in good working order. What they’re looking for:

- Electrical – the overall condition and type of wiring used throughout your home, as well as the manufacturer and the electrical panel itself

- Heating/ventilation/air conditioning (HVAC) – is there a central heating/air conditioning system? How old is it? Are there any signs of leaks?

- Plumbing – the type of pipes used throughout the home, along with the age of the hot water tank and any signs of possible leakage

- Roof/structure – What type of roof material do you have? How old is the roof and what’s the general condition? Are there signs of water damage or any missing tiles?

The examiner will fill out a detailed form for each of the 4 areas and will also take photos to provide to the insurance company.

Why is a 4-Point Inspection Needed?

In many cases, a 4-point inspection is required simply because of the age of your home. As a rule of thumb, if your home is 40 years old or above, most insurance companies will require a detailed 4-point inspection. If you have a newer home, chances are you won’t need to have this done at all.

If I’ve Had a Full Home Inspection Already, Can I Use This Instead of a 4-Point Inspection?

According to insurance experts in Florida, even if you’ve already had a full inspection of your home, you really shouldn’t volunteer any extra information to an insurance company than you have to. Sometimes a full report will include unnecessary details such as cosmetic or minor damage that won’t reflect well overall, so if you’re asked to only provide a 4-point inspection, do so.

What Does a 4-Point Inspection Cost & Who Conducts It?

On average, a 4-point inspection will run in the neighborhood of $50-100. If you’re not sure who to hire, consult the DomiDocs list of nationwide trusted service providers. Generally, if you’re switching insurance companies, you can use an already conducted 4-point inspection as long as it’s no more than 2 years old.

Does a 4-Point Inspection Reduce My Insurance Premiums?

No, a 4-point inspection simply identifies whether or not your home qualifies to be insured by specific insurance companies.

What Happens if My Home Fails a 4-Point Inspection?

Prospective insurance companies could decline to provide coverage for your home for any number of reasons not limited to:

- a damaged roof; a tiled/metal roof above 40 years old; a shingled roof more than 19 years old

- fire hazards as determined by the use of certain brands of electrical panels

- a home that doesn’t have a central HVAC system

- a water heater above the age of 18 years

- old plumbing or wiring

Sometimes an insurance company may still offer you homeowner coverage while excluding certain problematic areas, meaning if something happens with a non-covered system in your home, any repairs will be at your own expense.

The Insurance Document Bundle feature of DomiDocs makes it easy to catalog all of your vital household documents for your use, insurance agents, prospective buyers, and more. Your insurance policies are listed to show the company, coverage, cost, and start- and end-date of each, displayed with a calendar timeline for quick reference when needed.

Take Control of Your Homeownership Journey with DomiDocs®

Managing your home shouldn’t be stressful. DomiDocs® empowers homeowners with innovative technology, expert guidance, and unparalleled organization—all within a secure, cloud-based platform. From protecting your property and finances to streamlining essential tasks, our tools help you save time, reduce expenses, mitigate costly risks, and maximize your home’s value.

Explore the DomiDocs suite of solutions:

- Homeowner Enablement Platform® – A centralized, digital hub for organizing documents, tracking home value, and managing property details effortlessly.

- HomeLock™ – Protects your home from fraud and title theft with 24/7 monitoring and instant alerts.

- TrueValueIndex® – Provides real-time insights into your home’s value to help you make informed financial decisions.

- propRtax® – Identifies potential property tax savings and ensures you’re not overpaying.

- Documenting for Disaster® – Securely stores critical homeownership documents, ensuring quick access before and after a disaster.

Join the home management revolution today and experience the confidence that comes with having everything you need in one place.

Author – Connie Motz